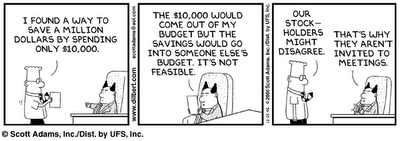

I've taught Capital Budgeting every semester since 1996 at some level or other (sometimes at the Intro level, sometimes in the Advanced Corporate class, and sometimes in the CFA prep course). One of the key concepts in capital capital budgeting is that in estimating cash flows you should always use the marginal cash flows attributable to the project at the

company level and not at the

divisional level. In fact, one of my favorite cases to teach this concept involves a multi-divisional company where each divisional manager is trying to allocate the revenues from the project to their division and the costs to someone else's.

The problem comes because of a classic agency problem: divisional managers are compensated in part on the basis of the financial performance of their division. Shareholder, in contrast don't care which division the costs and revenues are allocated to, since they have a claim on the cash flows of the

entire company. So, the interests of the agents (the managers) diverge from those of the shareholders (the principals) and voila: the managers take actions that shareholders would prefer they didn't.

Now I have the perfect Dilbert cartoon to illustrate the concept:

HT:

The Conglomerate Blog.

HT: The Conglomerate Blog.

HT: The Conglomerate Blog.